Lightspeed Restaurant

Fast, reliable payments straight from your POS.

Lightspeed Payments is the embedded payments solution built into Lightspeed Restaurant.

A better experience for staff and guests.

Get up and running fast with transparent, embedded payments.

- Reduce mistakes

- Speed up service

- Cash up in minutes

"We love that it’s integrated with our payment terminals, saves us time and there are less mistakes."

- Dot Lee, General Manager, LongshoreGet more out of each transaction.

Everything you need, all in one place.

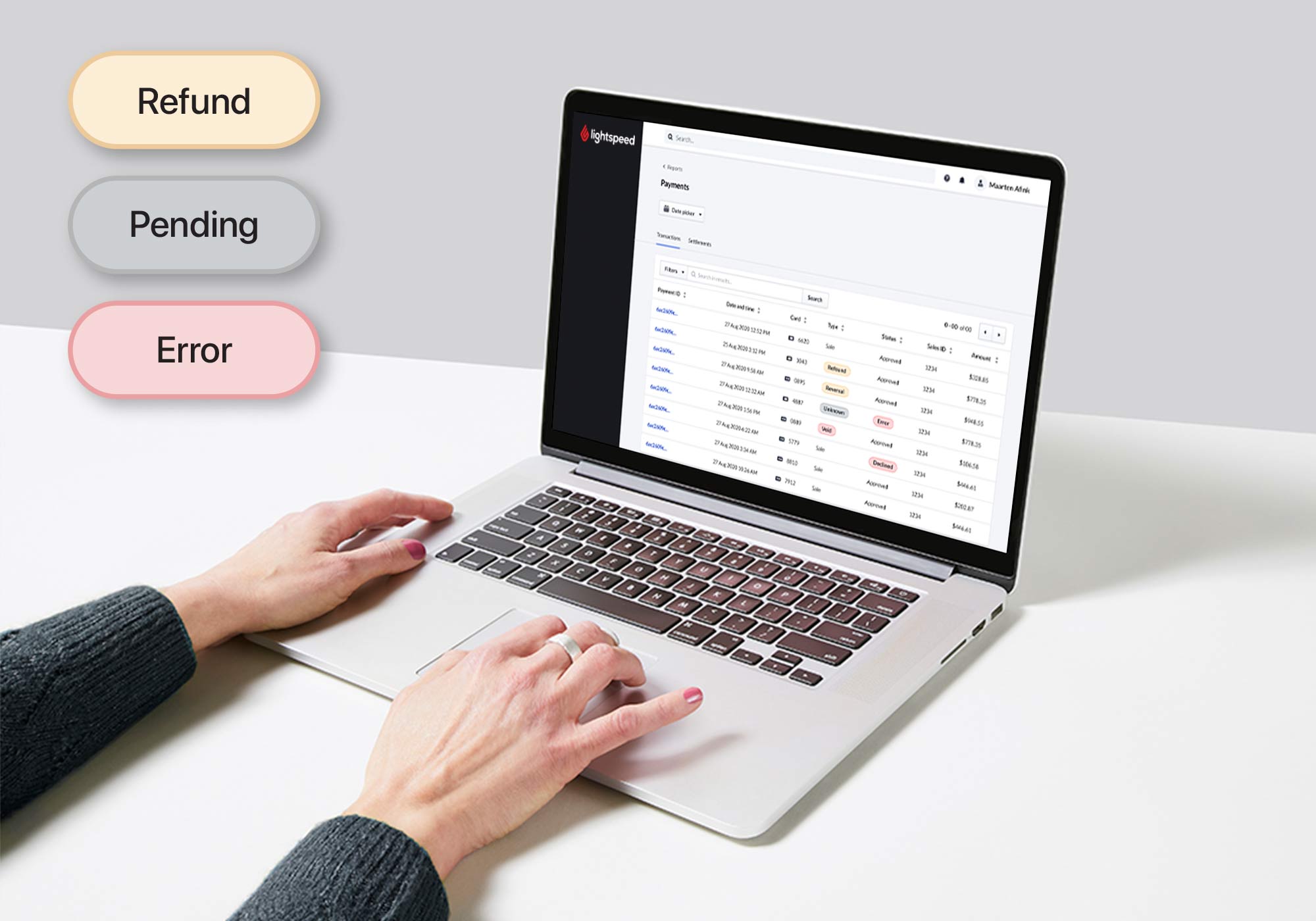

- Log into one system to review payments and sales

- Reconcile payment reports directly in your POS back office

- Access unique insights from payments data

Considering the switch to Lightspeed?

Switching to Lightspeed is easy. From data migration to hardware and payments setup, our industry experts will support you each step of the way.

- Get fast 24/7 support

- One-on-one onboarding

- Dedicated Account Manager to answer every question

Your hospitality management toolkit.

Lightspeed is your partner in success. Start optimising your operations with these free resources.